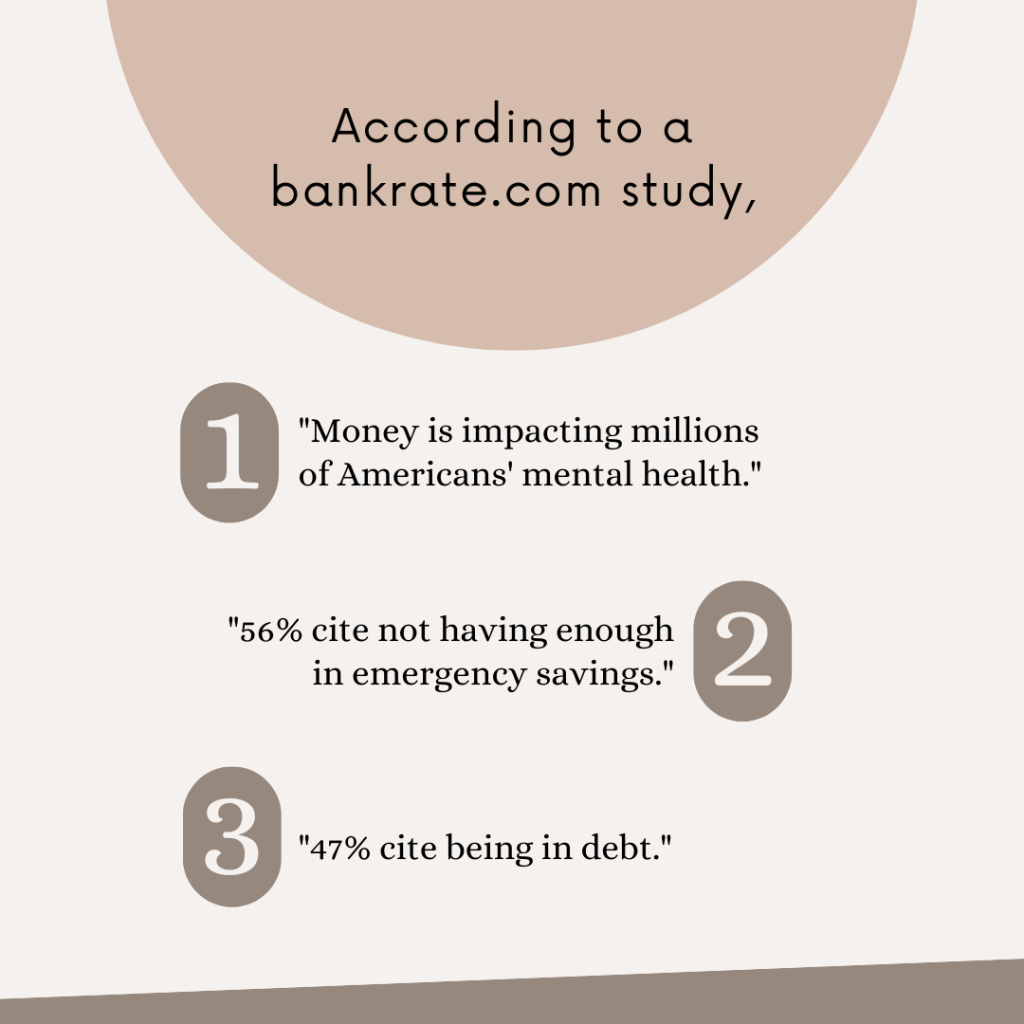

For many married couples, financial stress can feel overwhelming. Whether it’s managing debt, keeping up with bills, or trying to save for the future, these money concerns can weigh heavily on your relationship and your mental health. According to bankrate.com, nearly half of U.S. adults report that financial stress directly impacts their mental well-being, often leading to feelings of anxiety, sleepless nights, and even relationship strain.

Take Control:

I know that the rising cost of living and everyday financial pressures aren’t things we can control, but what if you could take charge of how you manage your money? That’s where a financial coach can make all the difference.

Working together, we can build a plan to help:

- Manage Debt: Whether it’s student loans, credit cards, or other forms of debt, it can feel like an insurmountable burden. But it doesn’t have to stay that way. We can develop strategies to pay it down without feeling like you’re sacrificing your future.

- Get Clear on Your Finances: Many couples wonder where all their hard-earned money goes each month. Together, we can track your spending and allocate your money in a way that aligns with your goals—making sure you’re not just covering the essentials but planning for the future too.

- Create a Plan That Works for You: A personalized spending plan can give you the clarity and control you need. We’ll make sure every dollar has a job so you’re not left wondering where your money went. By prioritizing what matters most, we can reduce the stress that comes from feeling out of control financially.

Let me show you how to gain control.

While I can’t lower the cost of groceries or housing, I can help you regain control over the things you can change. With a plan that’s built for your unique situation, you’ll not only feel more confident with your money, but you’ll also experience the peace of mind that comes from knowing you’re on the same page with your partner financially.

If you’re feeling the weight of financial stress, consider booking a free consultation. We’ll talk through your concerns, and I’ll share some initial steps you can take right away to ease the burden.

You don’t have to face financial stress alone—we can work through it together.