Are you and your partner dreaming of starting a family or growing in size? It’s one of life’s most beautiful journeys, but it’s also one that comes with new financial responsibilities. Imagine welcoming kids into a home with a rock-solid financial foundation—one where you’ve tackled debt, saved for emergencies, and have a spending plan that works for both of you. This peace of mind can be the difference between feeling financially overwhelmed and fully prepared.

The cost of raising a child from birth to age 18 in the U.S. averages between $260,000 and $310,000.

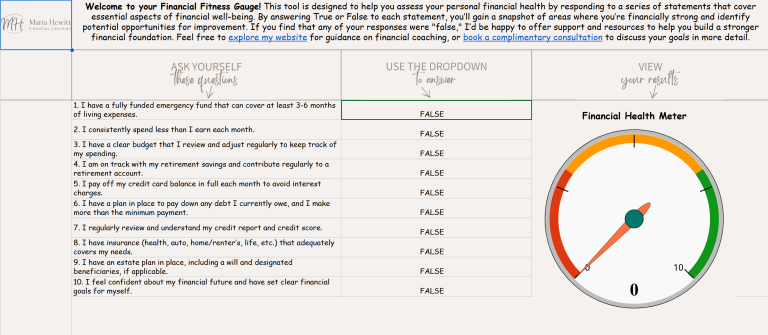

Getting your “financial house” in order can make all the difference.

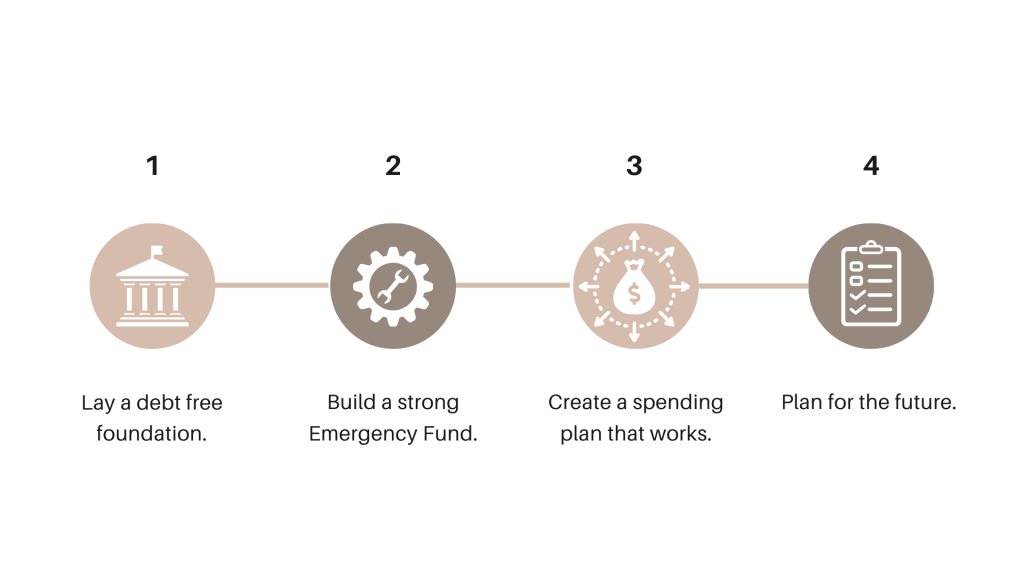

- Lay a Debt-Free Foundation

Before kids arrive, take the time to reduce or eliminate any lingering debt. The less debt you have, the more flexibility you’ll have to enjoy life with your growing family and face any unexpected expenses. Imagine the freedom of knowing your income is supporting your family, not your creditors! - Build a Strong Emergency Fund

Kids bring endless joy—and unexpected expenses! Whether it’s a trip to the doctor or a new baby item you hadn’t planned for, having a 3-6 month emergency fund can make sure these surprises don’t turn into stress. Financial security means you’ll feel more confident as you adapt to the beautiful chaos of parenting. - Create a Budget That Works for Both of You

Budgets aren’t about restriction—they’re about freedom! When you and your partner have a spending plan where both your voices are heard and your priorities are clear, you’re setting the stage for a smoother financial future. Take time to align on goals now so everyone’s on the same page when big decisions come along. - Plan for the Future—Yours and Theirs

Your child will be all grown up before you know it, and planning early can make a world of difference. Start thinking about how you’ll save for their college fund or future expenses, but don’t overlook your own retirement. The best gift you can give them is parents who are financially stable, now and in the future.

By laying the groundwork now, you can focus on what truly matters—cherishing time with your growing family. Financial planning is a gift to your future self and your loved ones.

Ready to dive deeper? Schedule a free consultation to create a customized plan for your family’s financial goals.